Our financial wellness courses are designed to meet people where they are—offering flexible, engaging, and practical education that fits a wide variety of settings. For school systems, we provide online educator workshops that easily integrate into existing curricula to supplement standard education with real-world financial literacy. These workshops equip educators with the tools and knowledge to confidently teach essential money management skills to students. For institutions seeking a more hands-on approach, we also offer in-person courses, where our expert instructors come directly to schools and organizations to deliver impactful, engaging lessons.

Online Educator Workshops

Professional development for teachers and school systems to integrate financial education into any classroom, aligned with existing standards.

In-Person Courses

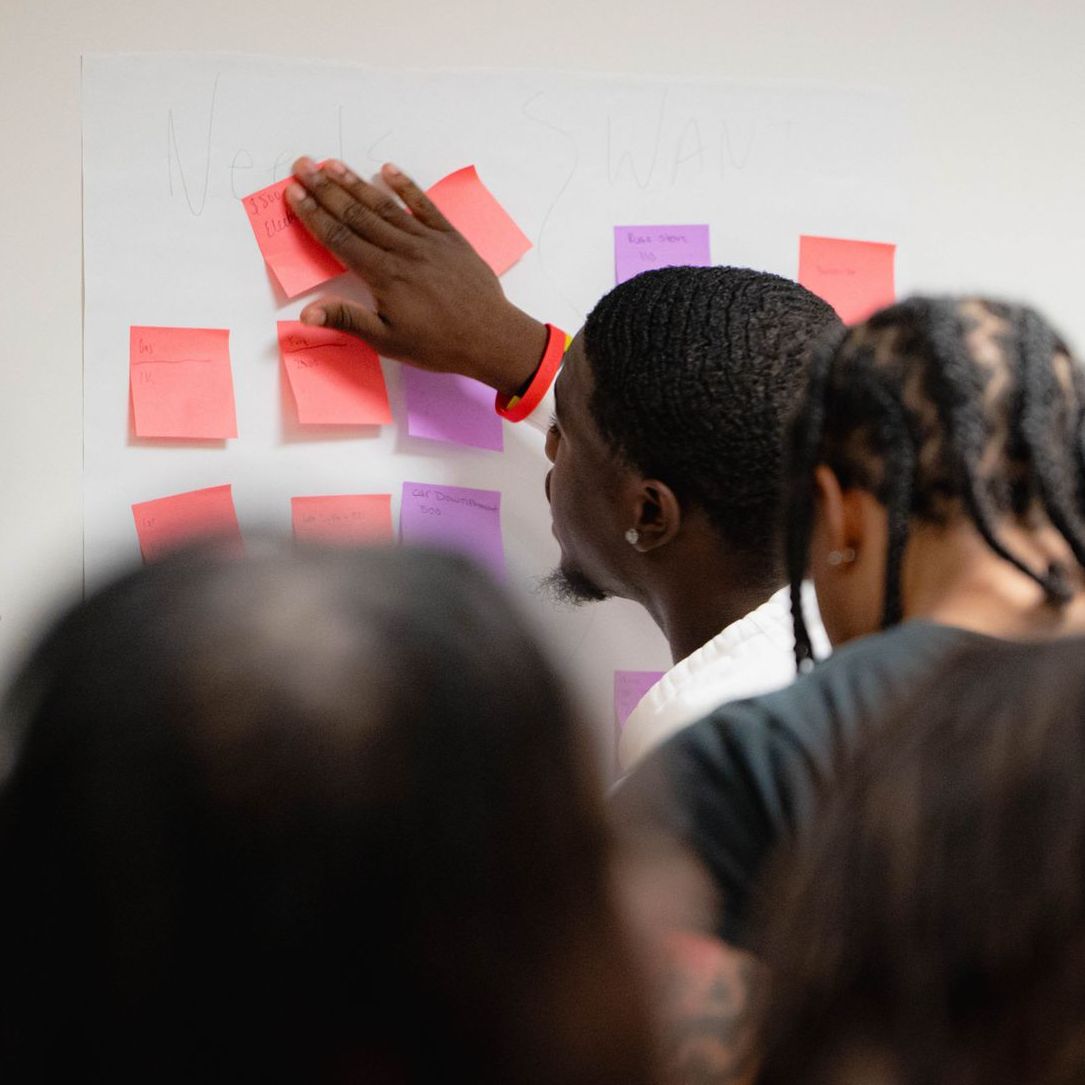

Dynamic,

hands-on sessions where our expert instructors teach directly to your audience — whether that’s a gym full of students, a corporate conference room, or a family reunion.

Private Group Sessions

Tailored financial wellness courses for any gathering, offering actionable money management lessons in an engaging format.

Why Financial Wellness Education?

Financial education isn’t just about dollars and cents — it’s about confidence, security, and opportunity. Our courses empower individuals and groups to make informed decisions that impact their lives, families, and futures.

- Practical, Actionable Skills

Participants learn how to budget, save, manage debt, build credit, plan for retirement, and more — all with tools they can use immediately. - Flexible Delivery, Built for You

Whether you need on-demand online courses or in-person workshops, we adjust to your needs and schedule. - Focus on Long-Term Financial Confidence

Our goal isn’t just to share information — it’s to help participants build lifelong confidence in managing money, making informed decisions, and creating lasting financial stability.

- Tailored to Diverse Groups

Our content is culturally responsive and designed to connect with learners of different backgrounds, ages, and experiences — from high school students to CEOs. - Engaging and Interactive

We focus on real-life scenarios, role-playing, and interactive exercises that make learning fun, memorable, and practical. - Lasting Impact

Our courses help reduce financial anxiety, improve decision-making, and build a foundation for long-term stability and success.

Who We Serve

Our financial wellness courses are designed to fit a wide range of audiences — because everyone deserves the tools to manage money with confidence. Whether you’re an educator, employer, athlete, or community leader, we’ll tailor our courses to meet the unique needs of your group and deliver real-life skills that make a lasting impact.

Corporations & Employee Resource Groups (ERGs)

Offer your employees financial wellness as a workplace benefit that reduces stress and boosts productivity. Whether through ERG partnerships or company-wide programs, our courses help employees at all levels feel empowered to manage their money.

- Topics include: Budgeting on a fixed income, credit repair, saving for retirement, understanding taxes.

- Perfect for: HR, ERGs, DEI initiatives, workforce development.

“An engaged, financially confident employee is a better employee — this program proved that.” — Corporate HR Manager

Summer Camps & Youth Programs

Add a valuable life skills module to your summer camp or youth program. Our fun, interactive lessons teach kids and teens about money in a way that sticks.

- Topics include: Spending wisely, setting savings goals, understanding money choices.

- Perfect for: Summer camps, youth groups, after-school programs, nonprofit initiatives.

“We give kids leadership skills, and this course gave them life skills.” — Camp Director

More From Our Students

Frequently Asked Questions

Got a question? We’re here to help.